There are two types of PayPal account you can use as a freelancer: Personal or Business. They are similar in many ways, and before I go any further I’ll say that you can definitely use either one. Both are free to use as well (although there are fees for transactions – more on that later).

However, there are some key differences to bear in mind. In this guide, I’ll talk about those differences, why some of them matter more than others, and which account is best for freelancers.

Using PayPal As A Freelancer

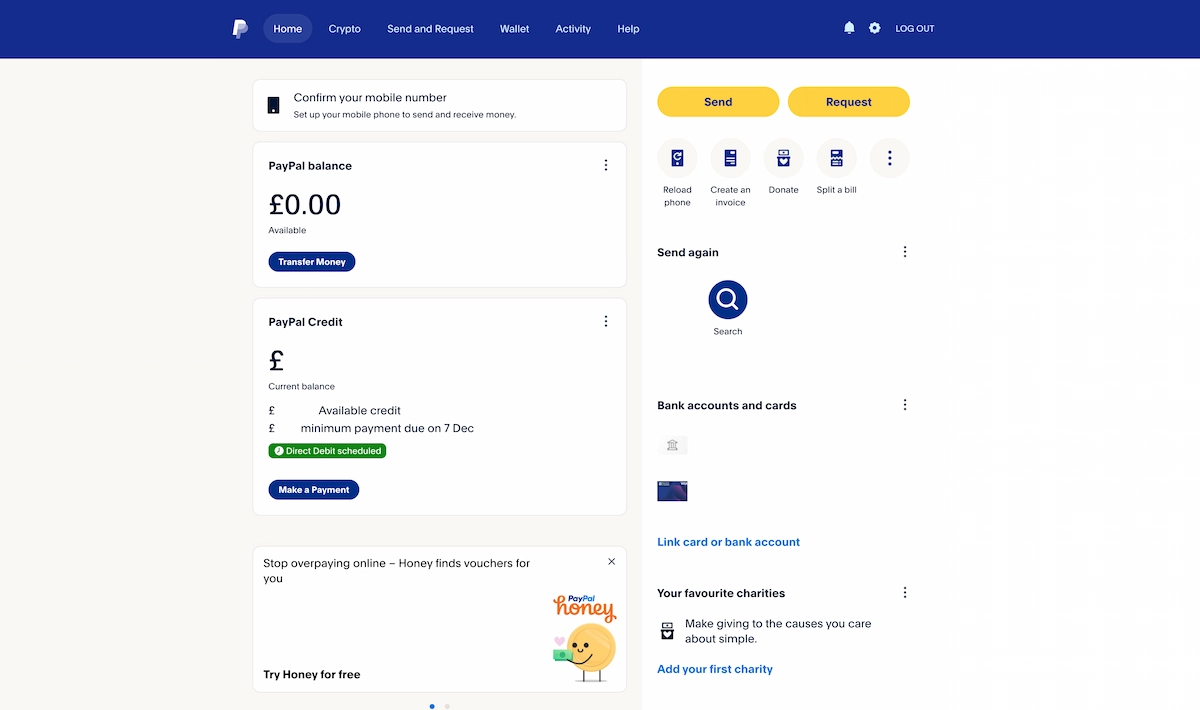

Using PayPal as a freelancer comes with several advantages, but it’s not without its drawbacks. PayPal is widely recognized and trusted, offering a secure and convenient way to send and receive payments globally. Its user-friendly interface and the ability to deal in multiple currencies make it a favored choice for freelancers with an international client base.

But PayPal’s fee structure, particularly for international transactions and currency conversions, is – in my opinion – suboptimal. Freelancers need to be mindful of these fees, as they can impact your earnings, especially for smaller transactions.

I use PayPal with some clients (largely thanks to the convenience factor), but I’ve moved to alternatives with others. My personal favorite is Wise. You can learn more about why in my guide to using Wise as a freelancer.

But for the sake of this article, I’ll assume you have at least some clients that prefer to use PayPal, or you prefer to use it for another specific reason. So let’s take a look at both accounts to find out which is best.

PayPal Personal Account For Freelancers

A PayPal Personal account is tailored for individuals managing their own finances, including freelancers. This account allows freelancers to send and receive payments, and it may be all you need. Let’s take a look at the pros and cons of using a Personal PayPal account as a freelancer.

Pros Of A Personal Account

- No business registration required: Freelancers, especially those starting out, might not have a registered business. A Personal account sidesteps this requirement, offering a straightforward setup. But so does a Business account – so while it’s a pro for Personal accounts, it’s not a reason to choose one over a Business account specifically.

- Invoice capabilities: Contrary to popular belief, Personal accounts also provide the functionality to send invoices, a vital tool for freelancers to bill clients. However, you may need to consider whether your payments will have buyer protection, as Personal accounts are typically designed to be used for – you guessed it – personal transactions.

- Lower fees for domestic transactions: For freelancers dealing primarily with clients within their own country, a Personal account can be more cost-effective due to sometimes lower domestic transfer fees. I’ll talk more about the fees later (as they can get confusing).

- Ease of use: PayPal’s Personal account is user-friendly, making it accessible for freelancers who may not be as tech-savvy (or for those that just want a relatively pain-free financial experience).

Cons Of A Personal Account

- Professionalism: A Personal account might not project the same level of professionalism as a Business account, which can be a consideration when dealing with clients.

- Transaction limits: PayPal Personal accounts may come with lower transaction limits than Business accounts, which might be restrictive for freelancers with a high volume of transactions or larger sums.

- Fees for physical payments: While not a primary concern for digital freelancers, those who deal with physical payments might find the fees associated with these transactions higher (again, more on that later).

- International fee structure: This is also a con for Business accounts – PayPal’s exchange rate spread is notoriously high, so you can lose a lot of money compared to using an app like Wise.

PayPal Business Account For Freelancers

For freelancers looking to elevate their business presence, a PayPal Business account can be an attractive option. This account type is designed for individuals and organizations managing business transactions (the clue is in the name!), and it’s particularly suitable for freelancers who wish to present a more professional image or manage higher volumes of transactions.

Pros Of A Business Account

- It looks more professional: Having a Business account can enhance a freelancer’s professional image, suggesting a more established operation to clients.

- Separate business and personal transactions: A Business account allows freelancers to keep their business and personal transactions distinct, simplifying accounting processes. It’s similar to how freelancers don’t need business bank accounts, but it can make your life much easier!

- No need to register: As with a Personal account, freelancers can open a Business account without having a formally registered business.

- Similar international fees: For freelancers dealing with international clients, the similarity in international fees between the Personal and Business accounts means there’s no financial disadvantage in choosing a Business account for global transactions.

- Invoice sending capability: Like the Personal account, a Business account also allows for the sending of invoices, which is a crucial feature for freelancers billing clients. However, I’d recommend using dedicated freelancing invoice software instead.

Cons Of A Business Account

- Fees: While the fees for international transactions are similar to those of the Personal account, there are merchant fees to be aware of for domestic transactions (see the next section).

- Complexity for smaller operations: For freelancers with simpler, lower-volume operations, the additional features of a Business account might add unnecessary complexity.

PayPal Personal vs Business Account Fees

The fees for PayPal Personal and Business accounts are where things can get confusing. I’ve seen some articles say there is a 2.89% + fixed fee for domestic Business payments, while others say 2.59% or even 3%. Things vary even more when discussing international payments.

So what are the real fees?

Well, they change from time to time, and to save all confusion, I’m just going to point you to PayPal’s pages on the topic. I’ve seen far too many contradictory opinions that I think it’s best you always just go straight to the source.

- Personal account fees – check this PayPal fees page

- Business account fees – check this PayPal merchant fees page

Which PayPal Account Should You Use As A Freelancer?

As a freelancer, choosing between PayPal’s Personal and Business accounts hinges on your specific business needs and goals. If you aim to maintain a professional image and handle high volumes or diverse types of transactions, a Business account is more suitable. It’s free to use, and so it may be worth setting one up just to keep your business transactions separate from your personal ones.

On the other hand, for those just starting out or working at a smaller scale, primarily with domestic clients, a Personal account might be enough. But if you’re dealing with international payments, I’d recommend looking into a different platform like Wise, which typically has much lower fees and better exchange rates.

Freelance Ready is reader-supported. That means some links on this website are affiliate links. If you sign up or make a purchase through these links, we may earn a commission.