Getting paid is one of the best bits of any job, but getting paid as a freelancer isn’t always straightforward. There are lots of different payment methods for clients to use, and you may therefore be wondering if Wise, formerly TransferWise, is good for freelancers.

Wise is good for freelancers as it offers a simple way to get paid for the work you do with low fees. Wise offers a simple interface paired with highly competitive exchange rates, making it a great choice for freelancers and for clients as well, no matter where in the world you are.

Below, we go into more detail about why Wise is so good for freelancers, and we discuss which is the right account for you. We’ll also go through the benefits and drawbacks of using the payment platform as a freelancer, to help you decide is it’s the right choice for you.

Is Wise (TransferWise) Worth It For Freelancers?

Wise, formerly TransferWise, is worth it for freelancers, thanks to its low fees and competitive exchange rates. It also has a very easy to use, intuitive interface, and it’s easy to both send and receive money. It’s also convenient for clients, making it ideal for both parties.

If you’re a freelancer in the digital space, be it a freelance writer, website designer, video editor, or anything else in between, there’s a high chance you have clients in other countries. As someone based in the UK offering freelance writing services, most of my first clients were based in the USA, which meant I got paid in dollars.

Better Exchange Rates

I also used PayPal for the most part, which while convenient and commonplace (most people have PayPal accounts for other purposes anyway), it did come with some pretty poor exchange rates. This meant I lost out on a decent chunk of earnings over time through the subpar exchange rates. This is one area in which Wise is truly great for freelancers that deal with multiple currencies.

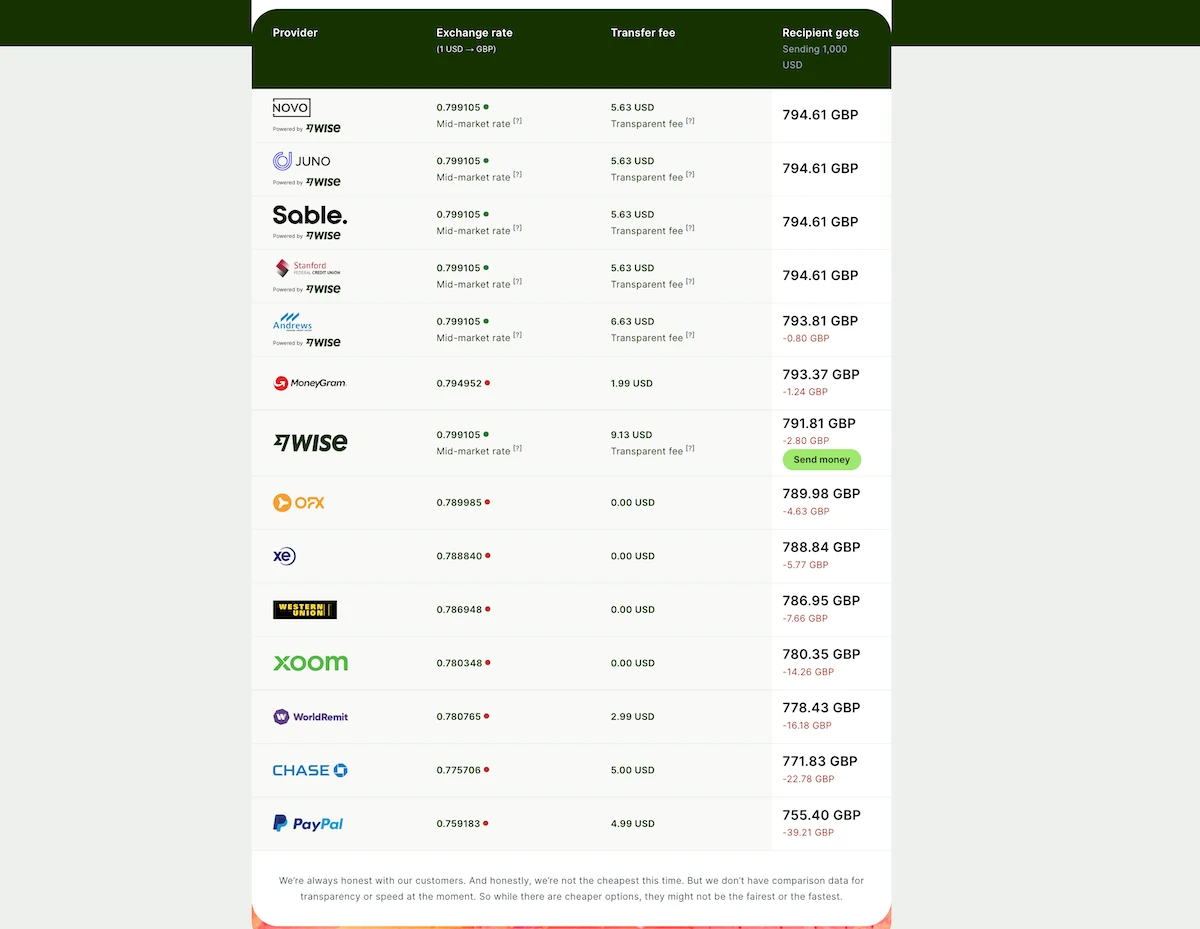

The fees on Wise are low as is, but their exchange rates – in my experience – are far better than those of PayPal and other payment providers. On low four-figure transactions to your own bank account, you can expect to save $20+ versus other platforms (sometimes even $100+). Over the course of many transactions per year, this adds up to hundreds of dollars (if not thousands) in saved money.

It’s Easy To Use

The ease of use of the platform is a big plus for freelancers too. When you live a busy life, you want managing your money to be as easy as possible. With Wise, it’s a case of getting paid on the platform, then sending your money to your chosen bank account. If you need to convert your currencies, you can do so with just a few taps or clicks. It’s simple and effective.

We’ll go through the pros and cons of the platform in more detail below, but first let’s compare the two types of account you can use as a freelancer.

Should Freelancers Use A Personal Or Business Wise Account?

Freelancers can choose to use either a personal or business Wise account, but I’d recommend sticking with the personal account. The business account doesn’t offer many benefits for freelancers, and it’s only really useful for bigger businesses. The personal account has everything you need.

In my experience, the personal account has been absolutely fine and has ticked all the boxes for me. I only use the platform to receive money from clients and pay the odd freelancer that I hire myself, and it does the job.

Built For Businesses

The business account is ideal for – you guessed it – businesses. If you have a lot of different money sources and expenses moving around, it has some extra features designed to make these easier to handle. You can also use this account with members of your team and you can manage individual access to various parts of the account. There are other features like invoicing and batch payment options, but these aren’t likely to be enough to persuade you to use it as a freelancer.

You likely have your own dedicated invoicing software, or you use something like Word or Excel. While a Wise business account does offer this functionality, the rest of the features are really targeted at organizations rather than individuals.

Wise Personal vs Business Account For Freelancers

| Feature | Personal Account | Business Account |

| International transfers at the mid-market exchange rate | Yes | Yes |

| Hold 50+ currencies | Yes | Yes |

| Have account details for 10 major currencies | Yes | Yes |

| Send money to 70+ countries | Yes | Yes |

| Lots of useful features for organizing your business’ finances | No | Yes |

| Customize access of people in your team | No | Yes |

| Generate invoices using the generator or array of invoice templates | No | Yes |

| Connect Quickbooks for simple bill paying | No | Yes |

| Batch payments of up to 1000 people | No | Yes |

In short, Wise business is best for organizations that handle many different income and expense sources, and deal in many different currencies. The personal account will be enough for most freelancers.

Benefits Of Wise For Freelancers

Low Fees & Good Rates

The first main benefit of Wise for freelancers is in its low fee, competitive exchange rate structure. I regularly save hundreds of dollars using Wise thanks to the exchange rates being much better than many other big payment providers. It’ll tell you when you go to make a transfer how much you’re saving versus other platforms (you can try it for yourself here). They’ll also be honest if they’re not offering the best rate and fee combination at that time, although they’re usually pretty close.

I understand moving money costs money, and platforms need to charge service fees to keep the lights on. But you’ll often get ripped off by other payment providers both in fees and in the difference between their quoted exchange rate and the mid-market rate. Wise always uses the mid-market rate, meaning you get a more accurate exchange rate than other payment providers offer – which means you keep more of your hard-earned money!

No Hidden Fees

But if you’re not using multiple currencies, Wise is still a great way to get paid as a freelancer. There are no hidden fees to worry about, meaning you get all of the money you’ve earned. You can also get rapid transfers, meaning the money can be in your account in just seconds.

Easy To Use

Wise is also very easy to use. In the modern era, having a website and an app to choose from is to be expected, and both of these work well in the case of Wise. I personally use the app 99% of the time, and it’s extremely easy to move money from Wise to my bank account. It has a simple interface, and I’ve never run into any problems with it.

Drawbacks Of Wise For Freelancers

The drawbacks of Wise are few and far between. For freelancers, you’re unlikely to come across any issues with the platform that make it a less attractive choice than its competitors. Some other services might cater to more currencies or countries, so if you think this could be an issue for you, it’s best to check with the Wise help center before deciding if an account is right for you.

There may be some other minor drawbacks if you’re a big business, but given you’re reading an article for freelancers, I doubt this is the case! Sure, you might not be able to day trade cryptocurrencies with the account, but I don’t imagine that’s what you want it for!

If you’re looking for a cheap and easy way to send and receive money as a freelancer, Wise is a great choice!

Final Thoughts

Wise is good for freelancers thanks to its simple interface, low fees, and competitive exchange rates. You can save a lot of money on exchange rates versus their competitors, but it’s also ideal for those that just need a quick and easy way to send and receive money as a freelancer.

Freelance Ready is reader-supported. That means some links on this website are affiliate links. If you sign up or make a purchase through these links, we may earn a commission.