Many full-time employees consider going freelance at some point. But you might be wondering if you can be a freelancer while working full-time, and what kinds of things you should consider before you do so.

You often can be a freelancer while working full-time, but there are circumstances where this won’t be possible. Typically, it depends on whether there is a conflict of interest with your current employer, and if they have any policies prohibiting you from taking on freelance work.

If you’re already a freelancer but want to take on a full-time job as well, you’ll obviously need to check with potential employers beforehand.

(You also need to think about your own capacity to manage both full-time and freelance work!)

Below, I’ll go into more detail about freelancing with a full-time job, and how you can balance the two.

Note: I am not a legal or financial advisor, and the information below is for educational purposes only. Useful resources from people far more qualified than me include Citizens Advice (UK) and the Department of Labor (USA).

Does Your Employer Need To Know That You Freelance?

The answer to this question depends on various factors, including your employment contract, company policies, and the nature of your freelance work. Let’s explore different scenarios to help you make an informed decision about whether you need to tell your employer that you freelance.

Review Your Employment Contract & Policies

Start by carefully reviewing your employment contract and company policies. Some companies have clauses that restrict or limit employees from engaging in outside work or freelance activities. These clauses are typically in place to protect the company’s interests, prevent conflicts of interest, and/or maintain confidentiality.

If your employment contract or company policies explicitly state that you cannot freelance or engage in outside work without prior approval, it’s important to abide by those guidelines. In such cases, it may be necessary to inform your employer and seek permission before taking on any freelance projects.

Consider Potential Conflicts Of Interest

Even if there are no specific restrictions in your employment contract, consider whether your freelance work could potentially create conflicts of interest with your full-time job. Conflicts of interest arise when your freelance activities directly compete with your employer’s business or divide your loyalty in some way.

If your freelance work is unrelated to your full-time job or doesn’t pose a conflict of interest, you may choose not to disclose it to your employer (I’m not qualified to comment on whether you should or shouldn’t do that).

However, if there is ANY potential overlap or if your freelance work could be perceived as competing with your employer, it’s best to be transparent and discuss the situation with your supervisor or HR department.

Evaluate The Impact On Your Performance & Commitment

Another aspect to consider is how your freelance work may impact your performance and commitment to your full-time job. If you believe that freelancing will not interfere with your ability to fulfil your responsibilities, meet deadlines, or maintain a high level of productivity, you might decide not to disclose it.

But if you anticipate that your freelance work could potentially affect your performance at your full-time job in any way, it may be beneficial to have an open conversation with your employer. By communicating your intentions and discussing any potential concerns or conflicts, you can work together to find a mutually agreeable solution.

In the worst-case scenario, you might just not be able to take on freelance work at this time. But perhaps you can come to a suitable arrangement in the future.

Maintain Professionalism & Ethical Standards

Regardless of whether you inform your employer about your freelance work, it’s important to maintain professionalism and adhere to certain ethical standards.

For example, you should avoid using company resources or conducting freelance activities during your regular work hours. Also respect any non-compete agreements or confidentiality obligations that you have agreed to with your employer.

Can Your Employer Stop You Freelancing?

The extent to which your employer can prevent you from freelancing while working full time depends on various factors, such as:

- Your employment contract

- Company policies

- Any agreements you have signed

Some employers explicitly prohibit freelancing without prior approval. And violating such terms can lead to you losing your job. Non-compete and non-disclosure agreements may also restrict your freelancing activities if they are related to your employer’s business or involve proprietary information.

Conflicts of interest are another consideration. If your freelance work competes with your employer’s business or is even just within the same industry, your employer may have valid concerns and could potentially limit your freelancing activities. Or you could be subject to suspension or lose your job completely. Not good.

There may be situations where you can freelance without facing restrictions. However, it’s crucial to approach freelancing ethically and professionally. Ensuring that it doesn’t interfere with your performance or commitment to your full-time job. (Which is a bit of a theme here.)

Further reading: Freelancing vs. Employment

Taxes For Freelancers Who Are Also Employed

If you are able to freelance while working full-time, it’s important to understand the tax implications of your dual income streams. Freelancing introduces additional considerations compared to traditional employment, as you’ll be responsible for managing your own taxes.

Self-Employment Taxes

As a freelancer, you’re considered self-employed, which means you’ll be responsible for paying self-employment taxes. Unlike your full-time job, where your employer withholds these taxes from your paycheck, you’ll need to calculate and pay them on your own for any of your freelance work.

These will vary depending on where you live, but generally you’ll need to pay some form of income tax among others. In the US there are social security and medical insurance taxes to consider. While in the UK you need to pay National Insurance.

What may also vary is how you calculate and pay your tax. You’ll need to disclose the tax you’ve already paid via your employer, and then work out what tax you’ll need to pay on your freelancing earnings. The tax you pay is calculated from your total income, which includes both your employment earnings and your freelancing earnings.

Personal note: I had a part-time job when I first started freelancing. And my experience filling out the forms through HMRC was fairly straightforward. Just make sure you double and triple check it all when you go through it!

Keeping Track Of Business Expenses

As a freelancer, you’ll have the opportunity to deduct certain business expenses related to your freelance work. These deductions can help offset your taxable income, reducing your overall tax liability. Some common deductible expenses include equipment purchases, home office expenses, professional services, and marketing costs.

To take advantage of these deductions, it’s important to keep detailed records of your business expenses throughout the year. This can include receipts, invoices, bank statements, and any other relevant documentation. Organizing your records will make tax preparation easier and ensure you claim all eligible deductions.

Should You Freelance Alongside Your Full-Time Job?

Whether you can freelance while working full-time is one thing. But the next question to ask yourself is whether you should freelance alongside your full-time job. Below are some things to take into account when making this decision:

Assess Your Availability & Commitment

Working full time means you already have a significant portion of your day occupied. So, take a moment to consider how much time and energy you can realistically dedicate to freelancing.

Ask yourself questions like:

- How many hours can you allocate to freelance work each week?

- Are there any flexible hours during your full-time job that you can use for freelancing?

- Are you willing to work evenings or weekends to accommodate your freelance clients?

- Can you maintain a high level of commitment to meet deadlines and deliver quality work?

Honest answers to these questions will give you a clearer picture of whether you can manage freelancing alongside your full-time job.

Define Your Freelance Goals

Determine what you hope to achieve through your freelance work. Is it to earn extra income, develop new skills, or explore your passion? Knowing your goals will help you stay focused and motivated throughout your freelance journey.

Consider the following goals:

- Financial: Are you looking to supplement your income or save up for a specific financial goal?

- Skill development: Do you want to expand your skill set or gain experience in a different field?

- Creative outlet: Are you seeking an avenue to express your creativity and pursue personal projects?

Understanding your objectives will guide your decision-making process and help you prioritize your freelance projects accordingly.

Remember, finding the right balance between your full-time job and freelancing is a continuous learning process.

How To Balance Freelancing While Working Full-Time

Build A Sustainable Freelance Workflow

To be a successful freelancer, you need to establish a sustainable workflow that fits into your existing routine. Here are a few tips to help you create a solid foundation:

- Set realistic deadlines: Avoid overcommitting and taking on more work than you can handle. Be honest with your clients about your availability and deliverables.

- Communicate effectively: Keep open lines of communication with your freelance clients. Respond promptly to their messages and set clear expectations regarding response times and availability.

- Automate administrative tasks: Streamline administrative tasks, such as invoicing and project management, by using software and tools designed for freelancers.

- Create a dedicated workspace: Designate a specific area where you can focus on your freelance work without distractions. Having a separate space can help you mentally switch gears between your full-time job and freelancing.

Learn To Manage Your Time

Managing your time effectively is crucial when balancing freelancing and a full-time job. Start by creating a schedule that accommodates both commitments. Identify the hours you can dedicate to freelancing and make a habit of sticking to your allocated time slots.

Remember, it’s important to prioritize your responsibilities. Your full-time job is your primary source of income and stability, so make sure it doesn’t suffer due to your freelance work. Establish a system that allows you to complete your job’s tasks efficiently while setting aside dedicated blocks of time for freelance projects.

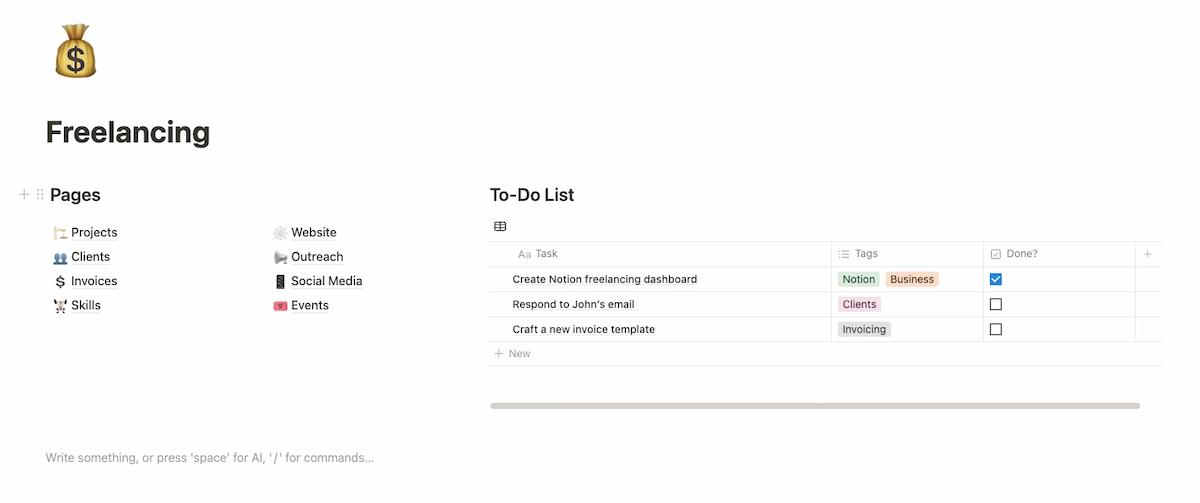

It’s a good idea to use some form of project management software. My favorite is Notion, and you can check out our guide to using Notion as a freelancer for more information.

Automate & Delegate

Streamline your administrative tasks and minimize time-consuming activities by using technology and automation tools. For example, you can use accounting software for invoicing and expense tracking.

Also consider delegating certain freelance tasks to trusted individuals or outsourcing platforms to free up your time for higher-value work. Clearly this won’t be possible for small-scale freelance projects. But as things get bigger and take more of your time, it could be worth bringing in some helping hands.

Create Boundaries & Practice Self-Care

You also need to establish boundaries between your full-time job and your freelance work. Avoid working on freelance projects during your regular work hours. Also allocate time for rest and relaxation to prevent burnout.

Maintaining a healthy work-life balance is essential for long-term sustainability in all cases. But this is especially true when trying to balance working full-time with freelancing.

Continuously Assess & Adjust

Finally, regularly evaluate your freelancing workload and its impact on your overall well-being. Assess whether you’re meeting your goals and maintaining a healthy balance.

Be willing to make adjustments if needed. Such as reducing (or increasing) your freelance workload based on your evolving circumstances and priorities.

The Importance Of Balancing Freelancing With Full-Time Work

Remember, finding the right balance between freelancing and a full-time job is a personal journey. It’ll likely require experimentation and adjustments to discover what works best for you.

For more tips on making your freelancing career a success, check out my guide on things to know before you go freelance.

Freelance Ready is reader-supported. That means some links on this website are affiliate links. If you sign up or make a purchase through these links, we may earn a commission.